What Are Digital Assets

Digital assets are electronically stored units of value or content, such as cryptocurrencies, NFTs, or tokenized assets, that are created, traded, and managed using digital technologies like blockchain.

Why Digital Assets Matter in 2025

In 2025, digital assets play an important role in reshaping global finance, commerce, and ownership. Their integration into mainstream systems—from tokenized real-world assets to decentralized finance (DeFi) and central bank digital currencies (CBDCs)—is driving efficiency, accessibility, and innovation. These assets empower individuals with greater control over value, while enabling programmable, secure, and borderless transactions across industries.

Key attributes that make digital assets valuable:

Programmability: Automates transactions via smart contracts

Transparency: Blockchain offers open, auditable records

Security: Cryptography ensures asset integrity and trust

Liquidity: Enables fractional ownership and 24/7 global markets

Interoperability: Cross-chain functionality enhances utility

Decentralized ownership: Users control assets without intermediaries

Global access: Financial inclusion for the unbanked and underbanked

Digital Assets | Physical Assets |

| Intangible and exist electronically (e.g., cryptocurrencies, NFTs, virtual real estate). | Tangible and exist in the real world (e.g., gold, real estate, machinery). |

| Easily transferable across borders through blockchain networks. | Require legal and physical processes for transfer. |

| Often decentralized and stored securely using cryptographic keys. | Typically centralized and involve intermediaries (banks, agents). |

| Allow fractional ownership and micro-investments. | Ownership often requires full upfront investment. |

| Prone to cybersecurity threats and scams if not managed properly. | Vulnerable to theft, damage, or regulatory constraints. |

Types of Digital Assets

Cryptocurrencies

Digital currencies that use blockchain technology to enable secure, decentralized transactions.

NFTs

Unique digital assets that represent ownership of digital items like art, music, or collectibles.

Stablecoins

Cryptocurrencies pegged to stable assets like the US dollar to reduce price volatility.

DeFi Tokens

Digital assets used within decentralized finance platforms for lending, staking, and trading.

Rise of Digital Ownership & Value

What is driving the rise of Digital Ownerships (Digital assets)?

In recent years, digital assets have become mainstream financial instruments, being extensively used for trading, investment and lending. Once met with scepticism, these assets are now viewed as legitimate investment products due to their utility within Decentralized Finance (DeFi) platforms. Another key trend that we observe is the increasing adoption of crypto-based payment systems. Many companies seem to be integrating these systems to access broader populations and reduce transaction costs. Perhaps the broader motivations behind increasing crypto adoption, seem to come from extensive benefits offered by cryptocurrencies – such as decentralization and global accessibility.

However, it’s important to note that demand for certain cryptocurrencies may fluctuate depending on certain macro-economical events and investor market sentiments, both of which contribute to price volatility. Some cryptocurrencies (such as BTC and ETH) seem to dominate the market and hold the majority of market share, making it difficult for newer crypto projects to survive or make gains. Macro-economical events such as interest rate change, Quantitative Easing (QE) implemented by central banks, geopolitical events, regulatory events, and blockchain innovations all seem to determine how much capital will flow into specific cryptocurrencies at any given certain time.

Why Digital Assets Matter for investors & Businesses?

- Portfolio Diversification: Investors can diversify into digital assets such as stablecoins, NFTs, or DeFi tokens, offering both high-growth opportunities and stable options. Yield farming and crypto lending are good options for making passive income with crypto.

- Automation: Businesses are leveraging blockchain infrastructure to automate certain operations to reduce costs. For example, smart contracts can automatically execute agreements (or transactions) without intermediaries, while decentralized systems improve transparency in supply chain tracking and payment processing.

- Lower Costs & Faster Settlements: Smart contracts and decentralized protocols reduce operational overhead and enable near-instant value transfer.

How Digital Assets Work?

Digital assets operate on blockchain networks, which provide a decentralized and transparent infrastructure for recording and validating transactions. Unlike traditional financial systems that rely on intermediaries, digital assets are built on distributed ledgers operated by multiple independent validators (nodes). These networks use cryptography, peer-to-peer protocols, and programmable logic to enable secure, trustless and autonomous operations.

- Smart Contracts: Many digital assets transactions, particularly in DeFi, are powered by smart contracts which are self-executing code deployed on blockchain, that automates transactions.

- Wallets and Keys: Ownership of digital assets is managed through private and public cryptographic key pairs, stored in digital wallets. These wallets allow users to interact with decentralized applications (dApps) securely.

- On-Chain Verification: All transactions and transfers of ownership are recorded on the blockchain. This ensures full transparency, immutability, and verifiability, allowing anyone to audit the transaction history.

Decentralized Finance (DeFi) Trends

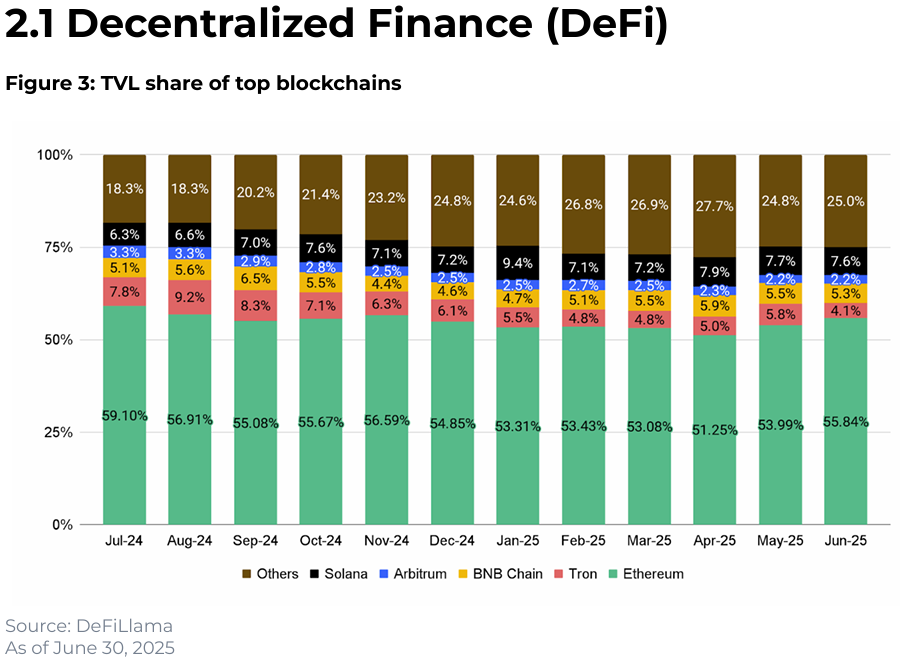

Dominance of Ethereum-based Protocols

Despite the volatile performance of cryptocurrencies – fuelled by reduced investor interest, during recent geopolitical instability, some DeFi protocols have shown growth in both popularity and Total Value Locked (TVL). The primary reason is investor interest in DeFi protocols is affected more by blockchain developments and technical upgrades than macroeconomic events alone. According to a report by Binance, Ethereum’s market share increased significantly in June 2025, while the shares of BNB chain, Arbitrum and Solana declined slightly.

This reflects investors’ preference for Ethereum as a DeFi hub during periods of macroeconomic uncertainty. Ethereum protocols have the highest TVL, deeper liquidity and a more interconnected ecosystem of dApps, providing better investment opportunities compared to other protocols built on other blockchains. As a result, Ethereum-based protocols continue to dominate the DeFi market.

Next-generation DEX architectures

PancakeSwap is a popular decentralized exchange (DEX) that has introduced several innovations, including the V3 upgrade, V4 modular architecture and the recent Infinity Upgrade (launched in April 2025). These upgrades have significantly reduced transaction fees, enabled deeper liquidity, and expanded support for advanced DeFi products such as staking and lending. The Infinity Upgrade, contributed to a substantial surge in PancakeSwap’s DEX trading volume. Similarly, many Ethereum-based protocols are working on next-generation automated market maker (AMM) architectures and technical upgrades aimed at reducing transaction costs, improving capital efficiency, and enabling the development of more complex financial products such as yield aggregators, derivatives and options protocols.

NFTs and Fractional Real Estate

Another notable trend within DeFi is the integration of NFTs with physical assets and the rise of fractional real estate investment. Non-fungible tokens (NFTs) are evolving beyond digital art into financial instruments that can represent ownership of tokenized physical assets. One emerging model uses NFTs to fractionalize high-value real estate, allowing multiple investors to co-own properties via blockchain-based smart contracts. Platforms like RealT, Lofty AI, and Tangible are pioneering this model, enabling investors to hold fractional ownership of real-world properties through NFT tokens, and earn income from rental yields and property appreciation in a decentralized way. This trend not only increases asset accessibility for retail investors but also brings traditional real estate into DeFi’s programmable and borderless financial ecosystem.

Use Cases of Digital Assets

Crypto-Payment Systems

Digital assets can be used to pay businesses or merchants through blockchain-based cryptocurrency payment systems. These systems facilitate near-instant, low-cost, and borderless transactions by removing traditional intermediaries like banks and money transfer services. Payments can be settled in seconds or minutes, even across countries, using cryptocurrencies such as Bitcoin, Ethereum, or stablecoins like USDC. Merchants benefit from reduced fees and faster access to funds, while users enjoy greater financial inclusivity—especially in regions with limited access to traditional banking infrastructure.

Art & Creative Ownership (NFTs)

NFTs are unique digital tokens deployed on the blockchain that represent ownership of digital art, music, collectibles, or in-game assets. These non-fungible tokens cannot be duplicated, making them ideal for verifying originality and provenance. Artists, musicians, and game developers can monetize their work by minting NFTs and selling them on decentralized marketplaces using cryptocurrencies like ETH. Smart contracts can also be programmed to automatically pay creators royalties each time the NFT is resold, ensuring long-term revenue and empowering independent creators with full control over their intellectual property.

Real Estate & Land Ownership (Virtual plots)

NFTs can represent ownership of both real-world properties and virtual land in metaverse platforms. For physical real estate, tokenization involves creating digital representations of property ownership on the blockchain—often through a legal structure such as an LLC. This ownership can then be divided into fractional NFTs or fungible tokens, allowing multiple investors to buy shares of high-value assets and earn returns from rental income or property appreciation. Blockchain ensures secure and transparent records, reducing the risk of fraud. In virtual environments like Decentraland or The Sandbox, NFTs represent digital pieces of land that can be bought, developed, or traded, creating new revenue streams and forming the basis of digital real estate markets.

Yield Farming & Staking (DeFi Tokens)

DeFi platforms allow users to earn passive income through staking and yield farming. Users can stake tokens by locking them in smart contracts and help secure blockchain networks (such as proof-of-stake chains) and receive rewards in return, often in the form of additional tokens. Yield farming involves providing liquidity to decentralized exchanges or lending protocols, enabling trading and borrowing activity while earning fees and incentive tokens. These mechanisms motivate user participation and help maintain the liquidity and functionality of decentralized finance platforms (DeFi).

Gaming economies and trading (Web3 games)

Web3 games integrate blockchain-based assets like NFTs and tokens, enabling players to truly own, trade, and monetize in-game items. Players can earn rewards through gameplay, sell rare digital assets on marketplaces, or trade tokens with other users. This creates player-driven economies where digital items have real-world value, and ownership is secured on the blockchain. The model supports interoperability, allowing certain assets to be used across multiple games or platforms.

Benefits and Risks of Digital Assets

Benefits | Risks |

Available 24/7, can be accessed through crypto wallet or platform | Blockchain network congestion can lead to slightly higher fees and slower transactions |

Fast transactions, lower fees than traditional finance | Crypto exchange can be susceptible to hacking, phishing, and scams |

Blockchain-based assets offer traceability and immutability | High volatility and speculative nature |

Strong cryptographic protection against fraud | Bugs or errors in smart contracts can result in financial losses |

Reduces reliance on central authorities or intermediaries | Loss of private keys means permanent loss of access to assets |

Enables new business models (DeFi, NFTs, tokenization) | Legal and compliance challenges across jurisdictions |

Variety of investment opportunities (e.g., crypto, tokenized assets, NFTs) | |

Smart contracts enable automation and trustless execution | |

Users have direct control over their assets |

FAQ

Digital assets are valuable digital items, represented on a blockchain. The ownership and transactions of digital assets are recorded on the blockchain. Users can access these assets through a crypto wallet, which is secured by a private key.

Examples of digital assets include cryptocurrencies, NFTs, and DeFi tokens.

The ownership and transactions of digital assets take place on blockchain technology — a distributed ledger secured by a network of independent nodes (validators).

In contrast, physical assets like fiat currency are stored, managed, and transacted through traditional banking infrastructure, which is centralized and controlled by financial institutions and authorities.

NFTs (Non-Fungible Tokens) are digital assets minted and recorded on a blockchain that represent ownership of digital art, in-game assets, or other forms of collectibles. Like cryptocurrencies, NFTs are stored in crypto wallets and can be transferred or listed on NFT marketplaces for trading.

If you are a game developer or digital artist, you can monetize your work by minting NFTs on popular platforms like Opensea.

Investing in digital assets carries risks, primarily related to security and price volatility.

The safety of your assets depends largely on the security infrastructure of the digital asset platform you use. It’s important to choose reputable companies such as Binance that offer multi-layered security, including cold storage, two-factor authentication (2FA), firewalls, regular security audits, and advanced data encryption.

Cryptocurrency prices are highly volatile. This volatility is driven by fluctuations in demand, interest rates, trading volume, and broader macroeconomic events.

Digital assets such as cryptocurrencies, DeFi tokens, and NFTs can be traded on blockchain-based platforms, offering the potential for profit through price appreciation.

Beyond tradability, these assets provide additional benefits. For example, DeFi tokens can be used for staking, lending, and yield farming, enabling users to earn passive income. NFTs can grant access to in-game economies, exclusive digital content, and premium digital art that can also be bought and sold.

Digital assets can be stored in crypto wallets, which come in two main types: hot wallets (connected to the internet) and cold wallets (offline and more secure). To store digital assets safely, use reputable wallet providers, enable two-factor authentication (2FA), and keep your private key or seed phrase confidential. For long-term storage or large holdings, we recommend cold wallets such as hardware wallets for enhanced security.

Regulation of digital assets varies by country. Some governments treat cryptocurrencies as property or financial assets, while others classify them under securities law. In many regions, regulatory authorities enforce KYC (Know Your Customer) and AML (Anti-Money Laundering) rules for crypto exchanges. However, the regulatory landscape is still evolving, and users should stay updated with local laws before trading or investing in digital assets through centralized platforms like crypto exchanges.

Top platforms for trading digital assets include centralized exchanges like Binance, Coinbase, and Kraken, which offer high liquidity and user-friendly interfaces. And top decentralized exchanges include Uniswap, PancakeSwap, and dYdX that allow peer-to-peer trading without intermediaries. Each platform offers different features, security measures, and supported assets, so users should choose based on their needs and experience level.

Cryptocurrencies like Bitcoin or Ethereum serve as digital currency and store of value, while DeFi tokens power decentralized finance applications. DeFi tokens are often used within protocols for lending, borrowing, staking, and governance. While both are blockchain-based and tradable, DeFi tokens typically have utility within specific platforms (DeFi), whereas cryptocurrencies are more broadly used for payments and transfers.

Web3 games are blockchain-based games that incorporate digital ownership, play-to-earn models, and decentralized economies. Players can own in-game assets such as NFTs and earn tokens through gameplay. These games run on smart contracts, enabling transparent and secure asset transfers. Popular Web3 games like Axie Infinity and CryptoKitties give players control over their assets, which can be traded outside the game.

Common scams include phishing attacks, fake airdrops, and pump-and-dump schemes. Scammers often impersonate legitimate projects or customer support to steal private keys or trick users into sending funds. They may send emails or messages to their targets or run deceptive campaigns that lead users to fake crypto websites. On these sites, users may unknowingly provide login credentials or sensitive wallet information.

To avoid scams, always verify URLs, never share your seed phrase, and research projects thoroughly before investing or connecting your wallet to unknown platforms.

CBDCs: How Digital Currencies Are Transforming Centralized Banking