How Crypto Trading Bots Work?

Crypto trading often requires managing an inventory of crypto assets, analysing price charts (through technical indicators), interpreting market data, and using different order types. Realizing the inefficiencies of this manual trading process, many traders developed script-based software in the early-to-mid 2010s for trade automation. Although these were simple programs, they later evolved into sophisticated algorithms that automate strategy-based trading.

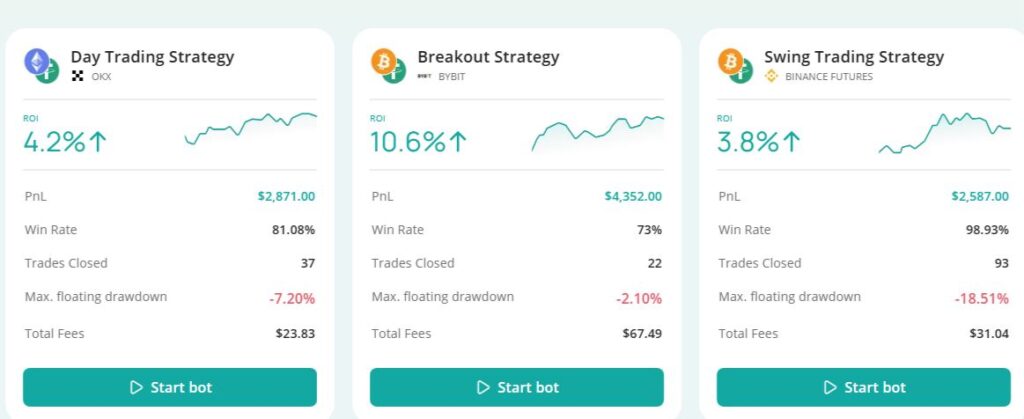

Trading bots are algorithms that execute trades automatically based on predefined parameters and rules. They utilize real-time market data provided by APIs and exchange data feeds to gain awareness of market conditions and deploy trades directly on crypto exchanges. One competitive advantage trading bots have over manual trading is their ability to operate 24/7. These bots are always analysing market data (including price charts, indicators, and order books), and can deploy trades at high speed. Hence, capturing short-lived profit opportunities becomes possible in the ever-changing crypto market, although success is not always guaranteed.

Strategy-Based Crypto Trading Bots

Each bot operates based on a certain strategy, aimed at optimizing trade entry and exit points. For example, a DCA bot utilizes the Dollar Cost Averaging strategy, which involves buying or selling assets in specific quantities at regular intervals to reduce the effect of price volatility on investment. Similarly, a grid bot operates within a price range, enabling traders to capitalize on optimal price points. An arbitrage bot buys crypto on one exchange and sells on another to profit from price differences.

These bots also enable much faster trading than is possible manually. They work with minimal latency and can execute trades in milliseconds, reacting to market conditions and placing orders almost instantaneously. In contrast, manual trading involves small delays which can lead to missing short-lived profit opportunities.

1. Grid Bot

This trading bot is well-suited for beginners who are just getting started with automated trading. Unlike long-term strategies which can be sophisticated, the grid strategy allows traders to benefit from short-term price movements in both directions. For example, suppose you select a specific price range such as $112,000 to $118,000 for BTC while the current price is fluctuating around $115,000, and you use grid spacing of $1,000. The bot will place buy orders at $112,000, $113,000, and $114,000, and sell orders at $116,000, $117,000, and $118,000. This strategy resembles short-term trading, as it focuses on capturing price movements within a defined range.

It’s important to note that the bot does not execute new trades if the price of the asset moves outside the predefined range.

Various dedicated platforms (that host bots on their own servers), such as 3Commas, provide grid trading bots. You can also use crypto exchanges like Binance and Pionex for automated grid trading. On Binance and Pionex, you can either manually configure the parameters or let the AI suggest optimal parameters for you.

2. DCA Bot

A DCA bot utilizes the Dollar Cost Averaging (DCA) strategy, which works well in bearish and sideways markets. In this strategy, a large investment is divided into smaller parts, each of which is executed at specific intervals. This helps spread the effect of price volatility across multiple entries (trade entry). If a large investment is made all at once, it can lead to bigger losses if the price downtrends. That’s why the DCA strategy is effective in reducing the impact of volatility.

Users set parameters such as DCA order size, frequency of orders (hourly, daily, or weekly), and target profit. The bot places buy and sell orders based on those parameters. By consistently buying assets at lower price points during downturns and selling at higher levels during uptrends, the bot aims to generate profits. However, the profitability of a DCA bot depends heavily on how well the asset’s price recovers after a downtrend or fluctuation.

3. Arbitrage Bot

Arbitrage bot leverages multiple markets rather than focusing on single market. It exploits price discrepancies between different markets or different exchanges to generate profit. The amount of profit earned depends largely on size of price discrepancies. Suppose BTC costs $105,000 on exchange A and $105,250 on exchange B, the bot would purchase BTC from exchange A and sell at exchange B, resulting in profit of $250.

Arbitrage trading can be challenging without the use of bots because manually executing trade can be slower and price discrepancies may disappear before trade is executed, resulting in missed profit opportunities. This is one example where trading bots are superior to manual trading.

4. Trend-Following Bot

Trend-following bots rely mostly on crypto market trends analyzed through technical indicators and signals. They use indicators such as Moving Averages, RSI, and others to confirm the existence of a trend and determine the best trade entry points.

Once a trend is identified—such as bullish price momentum—the bot enters the trade through multiple buy orders and exits once a reversal occurs after peak price. Similarly, during a downtrend, it may acquire crypto through multiple buy orders and sell them after a price reversal.

This trend-following approach can be tough to execute manually. You have to study the market, perform technical analysis, enter and exit multiple trades, and manage risk accordingly. One advantage of manual trend-following is that a trader can adapt and refine strategy in real-time and identify false trading signals.

5. AI Bot

The trading bots discussed earlier in this article operate based on predefined rules and instructions. These bots do not have the ability to learn from data, even though it may seem as if they are analyzing the crypto market. Reading market data to detect price trends does not mean the bot understands the market—it is simply following rules and scripts.

AI bots, on the other hand, are trained on large datasets and can actively refine their trading strategies. The datasets they use include historical price charts, social sentiment, order book activity, and on-chain activity. This allows the bots to weigh different factors influencing crypto prices and decide when to buy or sell.

One interesting advantage of AI bots is that a single bot can combine multiple strategies. For example, an AI DCA bot can buy crypto based on DCA rules and sell based on trends identified through technical indicators. The success of these bots largely depends on the quality and quantity of the data they are trained on. AI bots can still make mistakes and may not always adapt as quickly as the crypto market evolves.

Managing The Risks

While bots can be very effective in achieving higher returns by capitalizing on high-speed trading and built-in strategies, there is still a chance of losses if the market moves unfavorably. That’s why performing technical analysis before automated trading is crucial.

Before starting automated trading, consider the following steps:

- Learn the terminology of parameters used in trading bots.

- Understand how these parameters work and what they do.

- Backtest trading bots using historical price data to gain experience.

- Analyze different crypto markets to identify the best assets for investment.

- Start with low-risk strategies such as spot DCA and spot grid.

Understanding potential price movements and defining risk limits helps in setting parameters for bot trading. For example, if BTC price fluctuates between $114,000 and $117,000, in a spot grid you might define a grid with $113,000 and $118,000 as the lower and upper limits. You can also set stop-loss orders for automatic selling if the price drops below a certain level.

Another useful tool is simulated trading, which allows you to gain experience and see how your trading bots would perform under different market conditions without risking real capital.