Crypto staking, yield farming, and lending are some of the popular passive income methods. Many crypto exchanges have developed unique stake products like Simple Earn which combine staking and other strategies like liquidity farming to increase the rewards for users. Users also have the option to proceed with dedicated staking products which offer relatively lower APY rates than Simple Earn products. In this article, we will explore how you can earn money with delegate staking method.

Staking Process

In delegate staking, you simply deposit your crypto assets in a staking product. Many crypto exchanges and specialized staking platforms offer various staking products with specific APY (Annual Percentage Yield) and specific risks. You can also get different APY for same type of product on different platforms. That’s why, research prior to investment is crucial. Here’s the step-by-step process.

- Choosing the Crypto for Investment

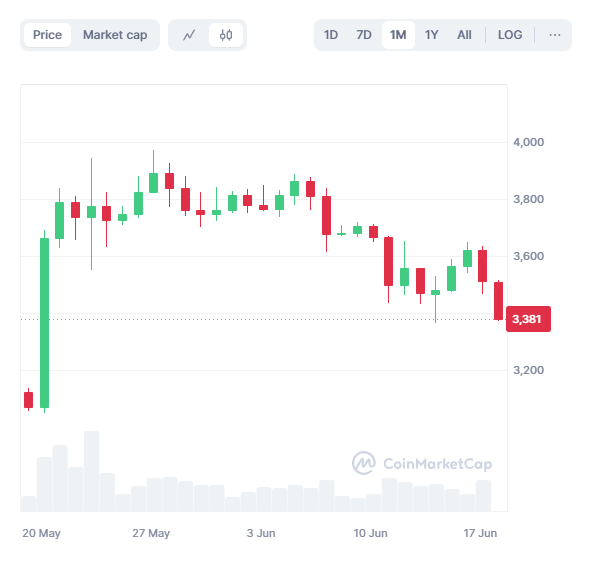

Don’t focus on platforms which offer most products with highest APY rates, rather focus on the platforms which offer specific coins which you want to stake. Identify a number of crypto which can be staked and have long-term bullish trend. Market events can affect the price of crypto. Research about these events, combined with analysis of price trends using charts and indicators, would be helpful.

- Choose the Best Staking Platform

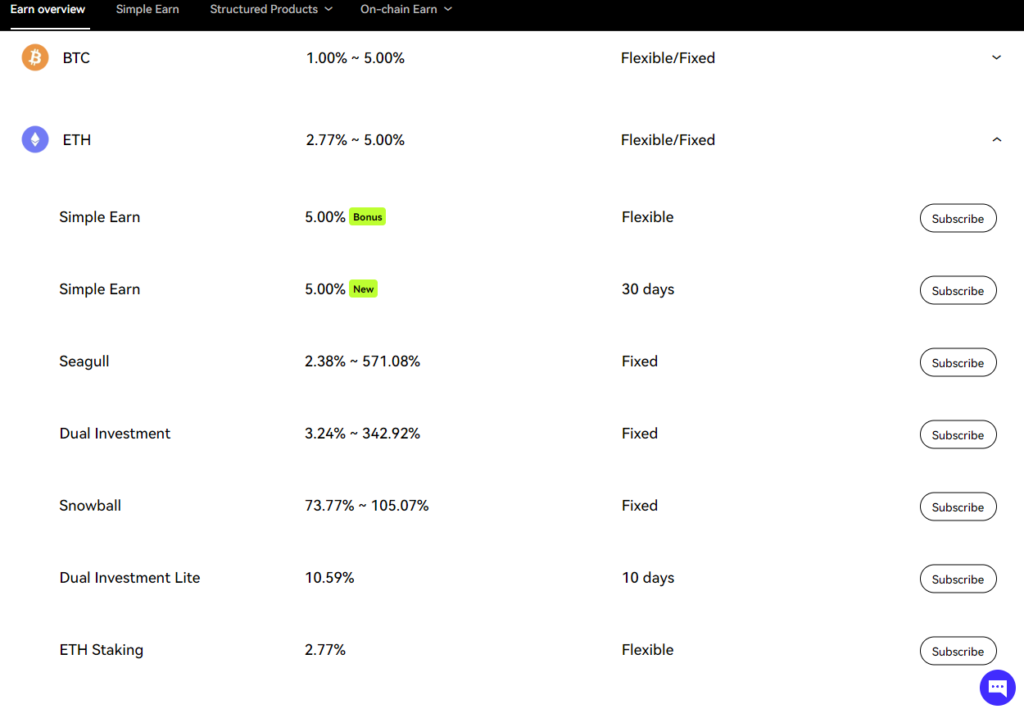

Both centralized and decentralized exchanges alongside specialized staking platforms offer the delegate staking service for a variety of coins. Once you have decided which cryptocurrencies you want to stake, then choose the platform which offers highest APY rate for these coins. OKX and Figment.io are among the best platforms that can be used for staking.

- Depositing Your Crypto

Sign in into your desired platform and go to the staking section. In case, you are using OKX platform, you need to go to “Earn” section. Next step is to select the coin you want to stake and you will be provided different earning options with fixed or flexible terms. You can subscribe staking option if available or choose Simple Earn which is a combination of staking and other strategies deployed by the OKX platform to help users earn passive income.

Many crypto exchanges like Binance and OKX also provide dedicated staking service for ETH. In that case, you may need to deposit your ETH coins to receive BETH which is a tokenized representation of staked ETH. After period of time depending on lock-up period, your BETH will grow in amount due to addition of rewards. Then you can redeem these assets.

Utilize Staking Rewards Calculators

The Staking Calculator is a popular tool for estimating staking rewards after specific period of time. You can give inputs like type of coin, APY rate, duration and amounts of coins. While some staking calculators do not give option to set custom APY, the calculator provided by Figment.io gives that option but has limited coins.

Crypto exchanges like Binance and some dedicated staking platforms also offer stake rewards calculators but they use specific APY rate for each crypto available in their stake products.

Risk Management

Even if you have chosen those cryptocurrencies having long-term bullish trend to safeguard your stake rewards, still managing the risk during the staking process is necessary. You can choose flexible staking option for some coins which have more uncertain price movements so you can redeem your assets in case of bearish trend or market downfall. Having some portion of your investment in staked USDT or other reliable stablecoins and some portion of investment in bullish coins guarantees better chances of high profits. Crypto market uncertainty always remains there, so calculating precisely how much you would potentially lose in case, those perceived “bullish coins” start falling in value, and how much you would earn, is part of the proper risk management. Specifically, in this staking strategy, you also need to observe performance of underlying blockchains for which you are staking coins, and also any changes in APY rates because these rates are often dynamic and may change depending on active number of validators for blockchain, network upgrades, coin demand or price and other factors.

Conclusion

Crypto exchanges and dedicated staking platforms simplify the stake process for crypto users through delegate staking services, where users delegate their assets to validators. Staking involves depositing your assets into specific products to earn crypto rewards after a period of time depending on APY rate and stake terms. A recommended strategy is diversified investment which involves staking multiple cryptocurrencies including stablecoins, to earn good profits. However, it is important to anticipate and understand all kinds of risks such as market volatility, and change in APY rates.