Gemini: Beginner-Friendly Crypto Exchange

Gemini is one of the best user-friendly crypto exchanges. It is suitable for new crypto investors who want to manage their crypto assets. Professional traders take benefit of its Active Trader, an advanced trading platform. Gemini supports over 100 crypto assets and multiple derivatives products for trading. Specifically for large-volume traders, it offers Over-The-Counter (OTC) trading service.

This US-based crypto exchange is regulated by New York State Department of Financial Services (NYSDFS). This crypto exchange is a very secure and reliable platform for normal and institutional investors.

Pros and Cons

| Pros | Cons |

| Beginner-friendly interface | High trading fees |

| Derivatives products also available | Small range of tradable assets compared to other crypto exchanges |

| Users can stake crypto | |

| Crypto credit card | |

Trading Fees

Gemini offers different fee structure for simple platform and Active Trader. Simple platform has relatively higher fees compared to Active Trader and the fees amount vary depending on the order size.

| WEB ORDER AMOUNT – USD | TRANSACTION FEE¹ – USD |

| ≤ $10.00 | $0.99 |

| > $10.00 but ≤ $25.00 | $1.49 |

| > $25.00 but ≤ $50.00 | $1.99 |

| > $50.00 but ≤ $200.00 | $2.99 |

| > $200.00 | 1.49% of your Web Order value |

And the fee structure for Active Trader is based on monthly trade volume rather than individual order size.

| 30-DAY TRADING VOLUME IN (USD NOTIONAL) | TAKER FEE | MAKER FEE |

| 0 | 0.40% | 0.20% |

| ≥ $10,000 | 0.30% | 0.10% |

| ≥ $50,000 | 0.25% | 0.10% |

| ≥ $100,000 | 0.20% | 0.08% |

| ≥ $1,000,000 | 0.15% | 0.05% |

| ≥ $5,000,000 | 0.10% | 0.03% |

| ≥ $10,000,000 | 0.08% | 0.02% |

| ≥ $50,000,000 | 0.05% | 0.00% |

| ≥ $100,000,000 | 0.04% | 0.00% |

| ≥ $500,000,000 | 0.03% | 0.00% |

Trading Experience

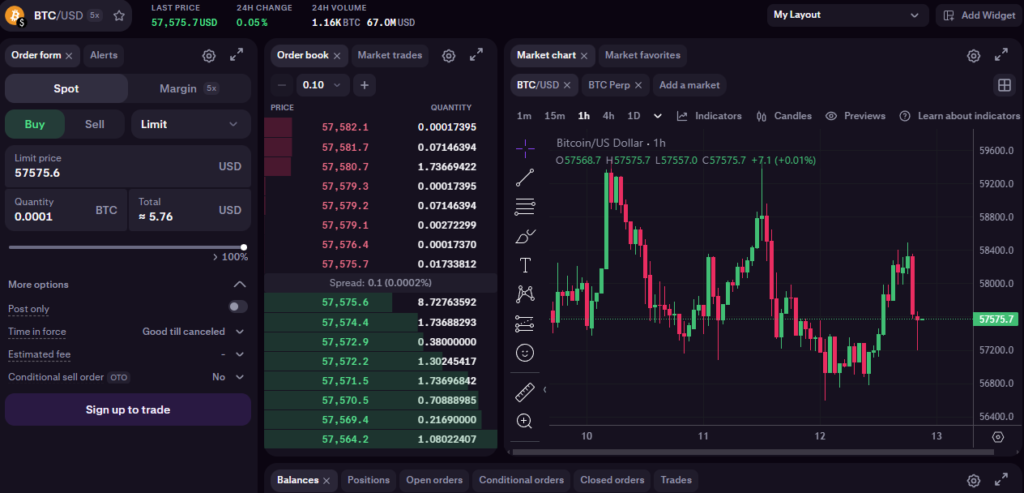

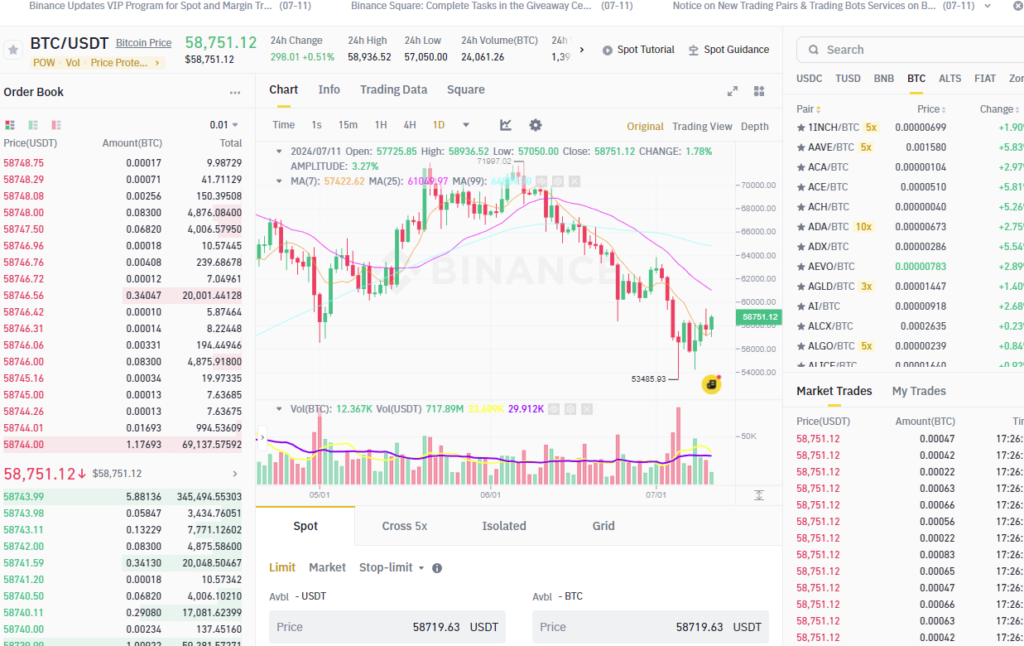

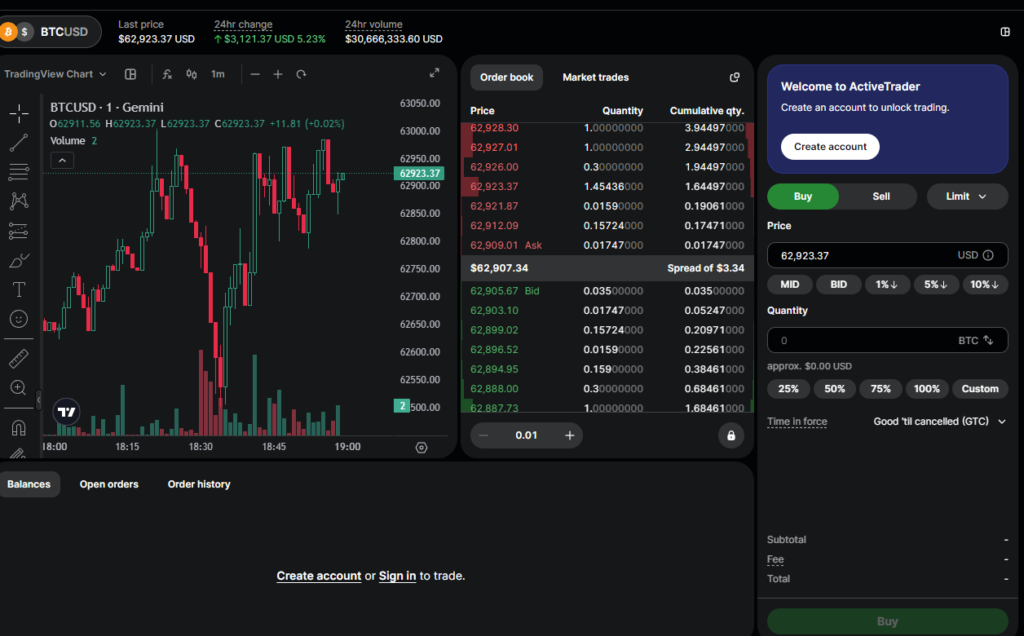

The Gemini exchange which is tailored for beginners has a simple interface and allows them to easily execute trades. They can also set recurring buys and view their portfolio. The only disadvantage of using this simple platform is the high fees. On the other hand, Active Trader is tailored for professional traders who want to execute custom trades like stop-limit orders. It provides advanced charting, technical indicators, and order book visibility. Unlike other crypto exchanges, Active Trader has fewer order types including limit, stop-limit and market.

Gemini’s spot trading services are available in the US, but derivatives trading is not available in US, UK or EU. Users from other countries can trade perpetual contracts with up to 100x leverage and enjoy fast trade execution speed.

Other Features

Gemini provides many other features including staking service, credit card, and a NFT marketplace all of which allow users to earn crypto. One of the downsides of staking on Gemini is that it provides only 3 assets for staking. Also, stablecoins are not available for staking. The credit card is one of the top features of Gemini that provides cashback rewards whenever you spend your crypto. Users do not have to pay any annual fee and can take benefit of world-class security of Gemini. And lastly, NiftyGateway is Gemini’s NFT marketplace where users can trade NFTs or digital art.

Customer Service & Satisfaction

Gemini does not provide multiple channels for customer support like live chat, email, and phone support. Customers can use the request form to submit a complaint if they have any issue. Gemini offers good amount of educational material specifically for the queries of customers.

On G2, Gemini got 17 reviews and overall rating of 3.7 out of 5. Customers seem to admire the user-friendly interface, high liquidity, credit card feature, and security of the platform. On the other hand, some customers complain about poor customer support, and restriction of services in some regions.

Company Overview

Gemini Trust Company was founded by two American investors, Cameron and Tyler Winklevoss in 2014. The crypto exchange is available in all states of the US. This crypto exchange is considered one of the most regulated crypto exchanges because of its adherence to highest level of capital reserve requirements and banking compliance standards. Gemini is also registered with FinCEN as money services business and complies with AML regulations. The industry-leading security of Gemini has also helped it earn SOC 1 Type 2 and SOC 2 Type 2 certifications. That’s why, Gemini is a very reliable crypto exchange for spot trading and other crypto-related services.