Dual Investment: Buy Low and Sell High

Dual investment is a popular strategy that relies on the market volatility of crypto assets to generate profits. This strategy involves buying an asset at a low price and selling it at a higher price, capitalizing on price fluctuations. While this approach can be executed manually, platforms like Binance and KuCoin offer Dual Investment products, with Dual Investment Binance being one of the most widely used for automating the process and making it more efficient and accessible. However, automated tools also come with their own limitations.

To maximize profits, investors need to have a good understanding of market trends and potential price movements. By purchasing an asset near its lowest point within a given period (such as the weekly low) and selling it when it reaches a higher point (such as the weekly high), investors can achieve substantial returns. Dual Investment Binance products combine these returns with additional yield opportunities, giving them an advantage over manual trading strategies.

Additionally, diversifying investments across multiple crypto assets can provide protection against the volatility of a single asset, reducing overall risk. Many traders build their portfolios around BTC, ETH, and BNB since these are widely traded assets that experience significant price fluctuations.

How Dual Investment Works

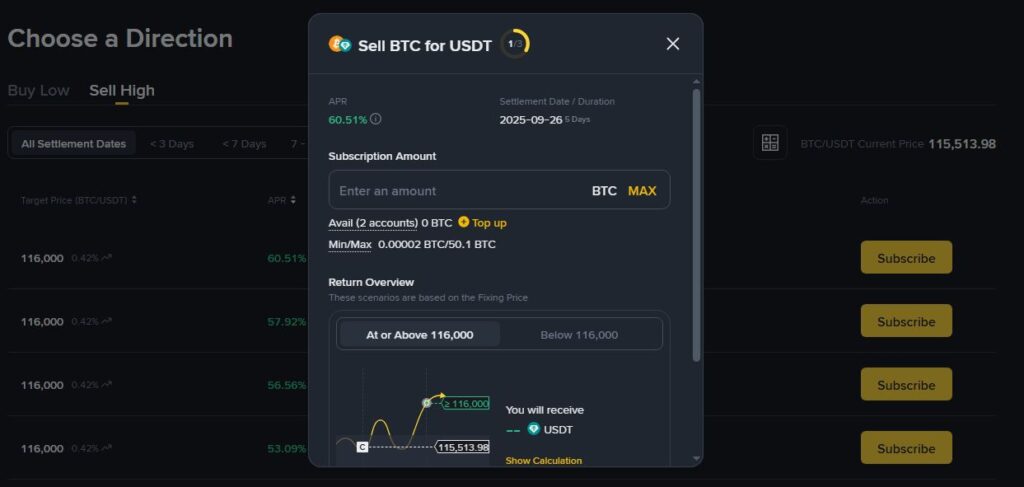

Dual investment allows users to exploit the market volatility of cryptocurrency assets by committing to trade execution at a specific future date and price. The Dual Investment tool functions similarly to limit and conditional order types, executing trades under predefined conditions. There are two main types of Dual Investment products: Buy Low and Sell High.

Buy Low: This product enables you to buy a specific cryptocurrency at a target price on the settlement date. If the market price is at or below the target price on the settlement date, the trade will be executed.

Sell High: This product allows you to sell a specific cryptocurrency at a target price on the settlement date. If the market price is at or above the target price on the settlement date, the trade will be executed.

If the Buy Low product successfully acquires cryptocurrency for you at the target price, you will need to manually set up a Sell High product for the newly acquired cryptocurrency. This Sell High product will then sell the cryptocurrency at your target price in the future to potentially earn a profit. Trades are executed only on the settlement date if the target price is met. Consider using the auto-compound feature to automatically re-subscribe to new Dual Investment opportunities at each settlement date if the target price is not reached.

Starting Investment on Binance

Dual Investment is among the structured products that let investors earn profits on crypto through an automated process. It is considered a passive approach because once you subscribe to a product, investments are executed automatically while you only need to monitor them.

Before subscribing to dual-investment products, it’s crucial to understand the key terminologies:

- Target price is the specified future price at which you aim to buy or sell your cryptocurrency.

- Settlement date is the date when the trade is executed and you receive your returns.

- Deposit currency is the cryptocurrency that you deposit to subscribe to the product.

- Target currency is the cryptocurrency you want to receive.

- Subscription period is the time between the subscription date and the settlement date.

To make informed decisions, analyze weekly or monthly price movements using charting tools and indicators to determine the optimal settlement date and target price. A Buy Low target must be set below the current market price, while a Sell High target should be set significantly higher.

If you have subscribed to multiple Dual Investment products, monitor their performance closely. The Basic Auto-Compound feature, enabled for each subscription, will automatically re-subscribe you to the plan on each settlement date unless the target price is reached or you choose to turn it off.

Risks and Rewards

The profitability of dual investment strategies largely depends on the target price and market movements. If the market moves in the favorable direction, the trade will be executed, potentially generating profits. For instance, the market price may hit the Buy Low target after you subscribed to Buy Low, acquiring crypto, and later reach the Sell High target after you subscribed to Sell High, resulting in profit. Success in this strategy depends on accurately anticipating favorable market movements and setting optimal settlement dates and target prices.

During the subscription period, yield accumulates and is distributed at settlement. To continuously benefit from investments, consider using the Advanced Auto-Compound feature, which re-subscribes you to a new position based on market conditions. If the target price is reached, the Advanced Auto-Compound feature will open a new position in the opposite direction. For example, if a Buy Low product successfully acquires cryptocurrency at the target price, the system will automatically set up a Sell High position for the same asset.

However, if the market does not move as anticipated, investors may face risks. Persistent unfavorable market conditions where the target price is not reached could delay profit generation or result in losses. The Auto-Compound feature will continue to re-subscribe to new positions based on the initial strategy, but this may not always lead to profitable outcomes if market conditions are consistently adverse. This means if a downtrend starts right after you acquire crypto, the Sell High target may not be achieved. Similarly, if an uptrend starts and the crypto price never falls to the Buy Low target, you may not acquire crypto.

Concluding Remarks

Dual-investment products, like auto-investment and staking, allow investors to potentially earn passive income with crypto. These products use algorithms to automate the execution of trades at a specified date and price, enabling investors to capitalize on market conditions. The general principle of dual investment is simple: Buy Low and Sell High. Users can acquire crypto assets at a lower price and sell them at a higher price to generate profit. The return on investment (ROI) depends on the target price, settlement date, the nature of the asset, and overall market conditions. That’s why sound knowledge of the crypto market can be helpful for this strategy.

Alternatively, many traders adopt a DCA (Dollar-Cost Averaging) strategy when the market is too volatile to predict. With DCA, they regularly invest small amounts of crypto during price fluctuations or downtrends, then sell when the price increases. This strategy can be executed manually or with trading bots. The manual approach offers more flexibility, as you can decide the exact timing of trades.