Spot vs derivatives trading: Key differences

| Category | Spot Trading | Derivatives Trading |

| Definition | Buying/selling the actual crypto asset at market price | Trading contracts based on crypto price (e.g. futures, options) |

| Ownership | You own the actual crypto asset (e.g., BTC, ETH) | No ownership of crypto asset; only exposure to price movements |

| Profitability | Depends on actual price increase | Can be highly profitable due to leverage; profit on both up/down movements |

| Risk Level | Lower risk (no leverage involved) | Higher risk (especially with leverage; risk of liquidation) |

| Leverage | Typically not available (or limited on some platforms) | Commonly used (up to 100x on some crypto exchanges) |

| Capital Requirement | Full capital needed to buy asset | Smaller capital needed (due to leverage) |

| Market Direction | Profitable only if price goes up (long positions) | Profitable in both directions (long & short) |

| Volatility Impact | Moderate impact on portfolio | High impact; small moves can cause large P&L swings |

| Trading Strategy | Simpler, longer-term (buy and hold, swing trading) | More complex (hedging, scalping, arbitrage, shorting) |

| Regulatory Clarity | More accepted and regulated | More scrutiny in some jurisdictions |

| Counterparty Risk | Lower (asset held in wallet or exchange) | Higher (risk of contract default, exchange risk) |

| Fees and Costs | Typically lower; no funding fees | Higher fees; includes funding rates and rollover costs |

| Skill Requirement | Beginner to intermediate | Advanced (understanding leverage, risk management, contract types) |

How Does Spot Trading Works

Spot trading involves buying and selling a crypto at market price while ownership of asset is transferred immediately from person to person. In this approach, you fully own the asset, and can sell it at market price, at any time unless you use limit order types.

It’s the most basic form of crypto trading, suitable for beginners because of simplicity. On centralized exchanges, spot trading operates through order book system which matches buyers and sellers and the assets are transferred from seller to buyer. On decentralized exchanges, smart contracts execute trades, moving assets from liquidity pools to buyers, enabling peer-to-peer trading.

Getting Started with Spot Trading

Here’s a step-by-step process to get started with spot trading:

- Choose Trading Platform: First step to start spot trading is to choose a reliable trading platform based on crypto asset availability, interface, security features and liquidity.

- Fund Your Account: You need to fund your account with fiat currency using bank transfer or credit cards. You can use this to purchase stablecoins like USDT for trading purposes.

- Choose Order Types: There are several order types that enable traders to execute custom trading strategies.

- Market Order: Basic order type used to buy/sell crypto at market price.

- Limit Order: Basic order type used to buy/sell crypto at specified price.

- Stop-loss order: Often used in day trading and grid trading strategy, to prevent losses if crypto price reduces below a certain level.

- Understand Charting System: Trading involves making decisions based on price movements, analyzed through candlestick chart. Different variations of candlesticks indicate different price movement patterns and understanding these is crucial before trading crypto.

- Utilize Technical Indicators: These indicators are used to analyze price movement patterns, price performance for certain timeframe, compare different price trends, to make informed trading decisions. Here are the commonly used technical indicators:

- Moving Average (MA): Moving average smooths out price data to identify price trends over time. It helps traders determine support/resistance levels and overall market direction.

- Relative Strength Index (RSI): RSI measures the speed and change of price movements to identify overbought or oversold conditions. Values above 70 suggest overbought condition, while below 30 suggest oversold.

- MACD (Moving Average Convergence Divergence): MACD shows the relationship between two moving averages of price. It helps identify trend reversals and momentum shifts through crossovers and divergence.

- Place Buy/Sell orders: After selecting a trading pair such as BTC/USDT, you can place a buy order and receive crypto once the order gets matched. Similarly, you can place a sell order to make profit if price increases after purchase.

- Navigating price volatility: The crypto market is highly volatile due to shifts in supply and demand, mostly driven by market events, investor sentiments, and global news. It’s important to monitor relevant events both before and during your trading activity, and to analyze price trends using technical indicators. This helps you identify favorable times to place buy and sell orders, reducing the risk of poorly timed trades.

Manual trading vs Automated Trading in 2025

Manual trading involves choosing order types, making investments manually, and monitoring crypto market to find best time to sell crypto. Professional traders often do technical analysis prior to making investment to identify price trends, and technical indicators to analyze current trends, for better timing of investments which is key to successful profits. Automated trading on the other hand, only requires setting parameters such as investment amount, strategy and rules that trading bot follows to execute trades. This approach eliminates the hassle of monitoring markets 24/7 and saves a lot of time.

Manual trading relies more on trading skills such as technical analysis, interpreting technical indicators, sentiment analysis (reading market data), risk management, and execution skills (e.g., using various order types). In contrast, automated trading relies more on parameter configurations, predefined trading rules, and technical indicators that the trading bot follows.

Despite the fact that automated trading involves less active decision-making—reducing the complexity that often arises from managing a portfolio, risk, and order types—it can still be risky for beginners. Bots only follow predefined strategies and rules, not the market intuition that experienced traders might apply. If market conditions change, the strategy may not execute successfully as intended.

| Aspect | Manual Trading | Automated Trading (Bots) |

| Trade Execution Speed | Slower — depends on human reaction and platform speed | Very fast — executes trades in milliseconds without delay |

| Strategy Customization | High — fully in your control, but limited by time and discipline | Very high — customizable algorithms, indicators, and timeframes |

| Profitability Potential | Variable — depends on trader’s skill and consistency | Potentially higher — can exploit 24/7 markets, but depends on bot quality |

| Risk Exposure | Lower if disciplined — trader can manually avoid bad setups | Can be higher — bugs or misconfigurations can lead to fast losses |

| Emotion in Trading | High — emotions like fear and greed often impact decisions | None — trades are emotionless, strictly rule-based |

| Time Investment | High — constant monitoring, research, and decision-making | Low once set up — mostly maintenance and optimization |

| Learning Curve | Moderate — requires market knowledge, technical analysis | Steep — requires coding knowledge or use of third-party platforms |

| Market Coverage | Limited — you can only monitor a few pairs/assets at a time | Broad — can watch and trade many pairs simultaneously |

| Adaptability | High — can respond to breaking news or anomalies quickly | Lower — bots don’t easily adjust to unexpected market news unless programmed to |

| Costs | Lower upfront — only trading fees | Higher — may include software subscriptions, VPS hosting, or development costs |

| Reliability | Depends on trader — subject to fatigue and errors | High — consistent performance, but may malfunction if not monitored |

Portfolio management & Diversification

Diversifying your crypto portfolio to multiple cryptocurrencies and structured assets (savings products, ETFs, futures) can help open more opportunities for profits and reduce impact of price volatility on your capital. But this also requires conscious re-allocation based on market performance of these assets and setting risk tolerance to take full advantage of diversification tactic. Beginners should only diversify to spot assets or spot and staking assets because this involves less risk and complexity.

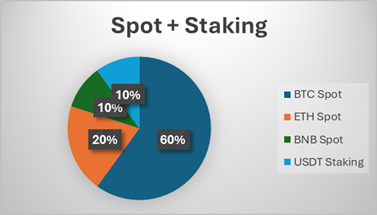

Setting different trading strategies for different crypto assets in your portfolio is typically a better approach. For example, day trading with ETH can be profitable due to its relatively higher volatility, while swing trading with BTC may be more suitable because of its comparatively lower volatility and more stable price trends. Staking stablecoins like USDT can provide passive income, helping to offset potential losses from spot trading. Typically, a diversified portfolio looks like this:

In this example, we allocate 60% capital to BTC spot trading, 20% to ETH, 10% to BNB, and 10% to USDT staking. These allocations are not fixed—you might consider rebalancing 30–40% to your BTC position if market conditions shift, such as ETH outperforming BTC. Regularly reviewing your portfolio is important to ensure your allocations remain aligned with asset performance.

Utilizing Trading Signals & Market Analysis (Fundamental & Technical Analysis)

To make informed trading decisions, it’s important to rely on trading signals and a combination of fundamental and technical analysis rather than guessing market directions based on limited news. Trading signals are cues—often generated by algorithms or analysts—that indicate favorable moments to enter or exit a trade. These signals are developed through technical indicator patterns and market events and can provide better understanding of market direction. Relying on technical indicators alone may not be enough if you want to dive deeper into market behavior.

Many traders subscribe to signal providers or use tools that generate custom signals based on specific strategies, such as breakout confirmation or moving average crossovers. These signals not only suggest when to buy or sell an asset, but also when you should refine your trading strategy.

Technical analysis involves studying historical price charts and market behavior to identify patterns and support or resistance levels. Popular indicators include RSI (Relative Strength Index), MACD, Bollinger Bands, and moving averages (MA). These tools help you assess the strength of an upward or downward trend and potential reversal points when price action is likely to change direction. When used consistently, technical analysis can guide you on when to place buy or sell orders.

Fundamental analysis, on the other hand, evaluates the underlying value and long-term potential of a crypto asset. This includes studying the project’s use case, tokenomics, team credibility, roadmap progress, and adoption rate. For example, rising developer activity, increasing popularity of that crypto on several social media platforms, and new partnerships could signal long-term value, even if short-term prices remain flat. Combining both technical and fundamental perspectives allows you to spot undervalued assets, avoid over-hyped projects, and build a well-informed trading strategy. This balanced approach is especially helpful when rebalancing your portfolio or deciding how much capital to allocate to a specific cryptocurrency.

Best Crypto Trading Tools

Apart from tools such as order types and technical indicators which aid in trading process, there are several other tools or algorithms specifically designed to execute custom trading strategy successfully. Some tools automate trading activity, while some tools provide market insights to make informed trading decisions. Here, you will find the best trading tools that can help in your trading activity.

1. Spot Trading Bots

Crypto trading bots first appeared in 2011-2013 as rule-based scripts that would automate trading process. Ever since, trading bots have evolved to more sophisticated algorithms that can execute custom trading strategies while also following selected list of technical indicators. Arbitrage bots and trend-following bots are some of the examples of this evolution. Trend-following bots have access to market events and news and can make decisions based on that to save the investment from losses and make better profits. Arbitrage bots are designed to make investments on one crypto exchange or market and sell asset on another to make profit from price difference.

If you want to do spot trading, spot grid bot might be best option due to its simplicity. It is specifically designed to execute trades in a predefined grid – buying crypto at lower end of price grid and selling crypto at higher end of grid. DCA bot is another popular spot trading bot that aims to automate small investments at regular intervals to reduce impact of price volatility on your capital investment. All these bots are available on platforms such as 3commas and Pionex.

2. Market Sentiment Analytics

These are platforms that deliver insights such as crypto inflows/outflows, whale movements, market sentiment, and collective investor emotions toward specific assets. These tools gather data from multiple sources, including social media, on-chain activity, market signals, and macroeconomic news. By using market sentiment analytics, traders can access real-time insights to better understand investor behavior and key market events. Based on this data, they can estimate current or future price trends and make more informed trading decisions.

We recommend platforms such as Glassnode and CryptoQuant for sentiment analysis. Both these platforms work closely with major financial institutions, crypto firms, and exchanges to provide deep, actionable market intelligence.

Top Trading strategies

1. Grid Trading

Spot grid trading is common strategy known for its simplicity. In this strategic approach you make profit from regular price fluctuations by placing a series of buy and sell orders across a predefined price range. This strategy works well in sideways or slightly volatile markets where the asset’s price tends to oscillate within a consistent band. For example, if ETH is moving between $3,100 and $3,400, you could build a grid to buy ETH every $50 below the current price and sell every $50 above, capturing profits on each swing.

In manual grid trading, you can use limit orders to pre-set buy and sell levels across your grid. For instance, you might set buy orders at $3,150, $3,100, and $3,050, and corresponding sell orders at $3,200, $3,250, and $3,300. To manage risk, you can add stop-loss order below your lowest buy level to prevent further losses if the market goes downward. Manual grid trading is best suited for traders who prefer more control and are actively monitoring price movements.

Alternatively, grid bots can be used to manage this entire process automatically. Once configured with your price range, grid size, and investment amount, the bot places and executes all orders as price fluctuates within the grid. This automation reduces the stress of manual trading and helps avoid emotional decision-making. However, automated grid trading may not perform well during strong trends or high volatility, where the price breaks out of the set range. Selecting the right asset and grid range based on market conditions is essential for success.

2. Scaling

Scaling strategy is mostly about position adjustment—entering or exiting trades gradually without allocating full capital to a certain price point. For example, instead of investing $1,000 in BTC at once, you invest gradually—$400 at one price point, $400 at another, and the remaining $200 at a further price dip. Then, you sell $500 at one higher price level, and another $500 at another level to make profits. This reduces the impact of price volatility and increases exposure to different profitable situations. A better approach is to invest larger amounts when the price hits lower lows and sell larger amounts when it reaches higher highs.

Scaling in is about making gradual investments based on price movement, while scaling out is about gradually selling your crypto holdings. The strategy can also be automated through the use of scaling trading bots. However, the manual approach provides more flexibility and control during the trade activity, especially when reacting to short-term market events.

3. Event-Driven

Unlike grid or scaling strategies that rely on predefined price levels, the event-driven strategy involves entering or exiting trades based on triggers caused by significant market events or trading signals. These events may include exchange listings, regulatory updates, interest rate decisions (made by central banks), supply burns, or major upgrades to a crypto project’s blockchain. In this strategy, you invest in a crypto that is expected to rise in value due to impactful developments and then sell it once the price reaches a profitable level.

DeFi coins such as ETH and UNI are often suitable for this strategy, as their prices tend to react strongly to DeFi-related upgrades and ecosystem-wide adoption. For instance, a major upgrade in Ethereum’s scalability or gas fees can attract investor attention and trigger a price increase.

The key to success with event-driven trading is to identify high-impact events early—before the broader market reacts—and position your trades accordingly.

Conclusion

Understanding the differences between spot and derivatives trading is essential for choosing the right strategy that matches your risk tolerance, skill level, and investment goals. Spot trading offers simplicity, real ownership of crypto, and is well-suited for long-term investors and beginners. Derivatives trading, on the other hand, opens the door to leverage, short selling, and advanced strategies—but comes with higher risks and requires greater experience.

Whichever strategy you choose, successful trading depends on informed decision-making, whether through technical and fundamental analysis, utilizing trading signals, or leveraging sentiment analytics tools like Glassnode and CryptoQuant. Platforms today offer both manual and automated trading options, giving traders the flexibility to execute custom strategies like grid trading, scaling, or event-driven tactics with or without constant monitoring.

Finally, a well-structured portfolio and clear strategy—not impulsive decisions—are the foundation of profitable trading in the fast-moving crypto market. Whether you’re investing manually or using bots, staying informed, and adaptable will always give you an advantage.