In the past week, many altcoins and also BTC have been performing bad except some of the top stablecoins. There was decrease in prices observed across the market. BTC dominance has been increasing in long-term since 2023 and currently stands at 53.31%. This means, Bitcoin has been performing relatively better than altcoins in long-term from start of 2023 to mid-2024. This is possible due to more capital flowing to BTC rather than altcoins or altcoin prices performing relatively worse which causes an increase in BTC share of crypto market. Evaluating the price trends and performance of altcoins in absolute terms also provides broader perspective of how they are performing against BTC.

Performance of Top Altcoins

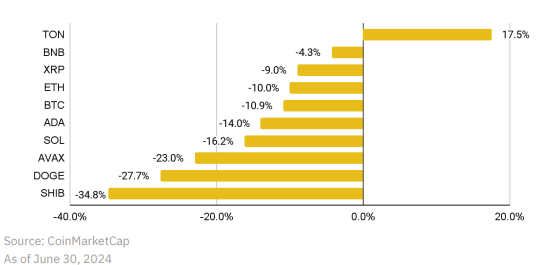

During the first quarter of 2024, prices of many coins started increasing and many investors had positive sentiment about crypto prices. By the start of second quarter and summer-2024, downward trend has started. According to a report by Binance, in June, crypto market cap decreased by 11.4% which was caused by various factors. Crypto assets were being sold in large quantities which sustained downward trend. Most prominently, US and German governments transferred substantial amounts of BTC to centralized exchanges which caused selling pressure among crypto investors.

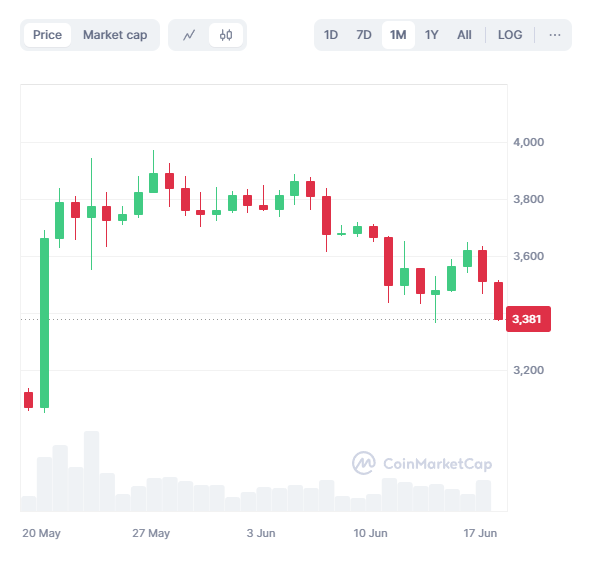

The altcoins with declined prices includes Ether, BNB, SOL, and Dogecoin. ETH has sustained upward price trend in initial months of current year, fuelled by halving event, announcement of ETH ETF approvals, and overall positive sentiment. Since the start of June to 9th of July, ETH price experienced 18% decrease. Certain events along with reduced investor confidence contributed to this. The anticipated launch of spot Ethereum exchange-traded funds (ETFs) in the United States on July 2 was expected to fuel a price rise for ETH. SEC has delayed this process. Furthermore, SEC has also increased regulatory crackdown mainly affecting Ethereum-based DeFi platforms.

BNB which has world’s 4th largest market cap achieved its ATH on 7th June reaching $710, but didn’t keep the upward trend and its price also has now decreased to $515. Regulatory crackdown on Binance by FCA is also behind this price decrease.

Solana’s network outage also caused SOL’s price to decrease. Currently, these major events contribute to negative market sentiment for the top altcoins. We also observe resilience in some cryptocurrencies like TON. Moreover, during the past week, ETH price also shown some resilience reaching $3079 after hitting $2832.

Interestingly, even Ether’s demand has decreased in recent month, its supply keeps increasing which may be due to Dencun upgrade. But this recent development in the blockchain reduced the transaction fees and is favourable for Ethereum-based DeFi procotols. The developments in the Ethereum blockchain empowers the DeFi ecosystem and can drive Ether’s price and adoption. This is also observed for SOL which is native coin of Solana blockchain. While blockchain upgrades boost coin’s adoption, the value of coin may still decrease due to regulatory crackdowns and fear among the investors which cause sell-offs.

Relative performance of Altcoins and BTC

Large-scale selling of specific cryptocurrency can shift investors’ interest to other cryptocurrencies. The halving of BTC which reduced miner reward from 6.25 to 3.125 BTC caused many miners to sell-off the coins in large quantities which reduced BTC price. While, large-scale selling also occurred for other coins, but cryptocurrencies like TON and SOL show better price performance than BTC in recent month. From June to July, TON’s price has gained back the upward trend after hitting lowest point of this month and had 2.6% increase. According to Binance’s report, BNB is top performer among exchange-related token. This is also because BNB reached its ATH in June. Binance’s events have sustained good demand for this coin.