Decentralized Exchanges Explained: AMMs, Liquidity Pools, and Why They Matter

Decentralized exchanges operate through a unique trade system called an Automated Market Maker (AMM), rather than relying on the centralized order book system. In this system, crypto investors trade directly with liquidity pools (funded by liquidity providers, or LPs) instead of trading with each other. Uniswap was the world’s first decentralized exchange to popularize this innovative model, helping to solve the issue of liquidity in the crypto space.

Moreover, users store their funds in self-custodial wallets, which may or may not be integrated with DEXs. This means users have full control over their private keys when storing funds. These qualities make DEXs more decentralized, as they are not fully managed by a single company. Trades on these platforms are executed by smart contracts deployed by developers.

The decentralized nature of these platforms provides advantages such as self-custody of funds, reduced fees, global accessibility without geographic restrictions, exposure to a wide range of tokens, and innovative financial services like yield farming. However, there are also associated risks, which we discuss in this article.

How Decentralized Exchanges Work and How to Choose the Best DEX

DEXs introduced the Automated Market Maker (AMM) system to simplify the trading process and achieve high liquidity. The AMM system relies on liquidity pools funded independently by liquidity providers. These providers deposit their tokens into a pool, which typically consists of a token pair.

- When traders purchase token A, they sell token B, keeping the product of the pool’s token quantities constant.

- The price is determined by the constant product formula x·y = k and is adjusted after each trade.

Larger trades relative to pool size may cause slippage or significant price changes. Smart contracts handle trade execution, update the pool balances, and reward liquidity providers with a portion of the trading fees. This way, liquidity providers are incentivized to keep funding the pool.

Users do not need to register an account or complete KYC on a DEX. Instead, they connect their wallet to the platform to start trading. This also means users are responsible for custody and safety of their assets, and must always choose a secure crypto wallet.

To choose a good DEX, consider factors such as:

- Number of available pools

- Specific tokens available for trading

- Trade volume and trading fees

- Yield farming and staking opportunities

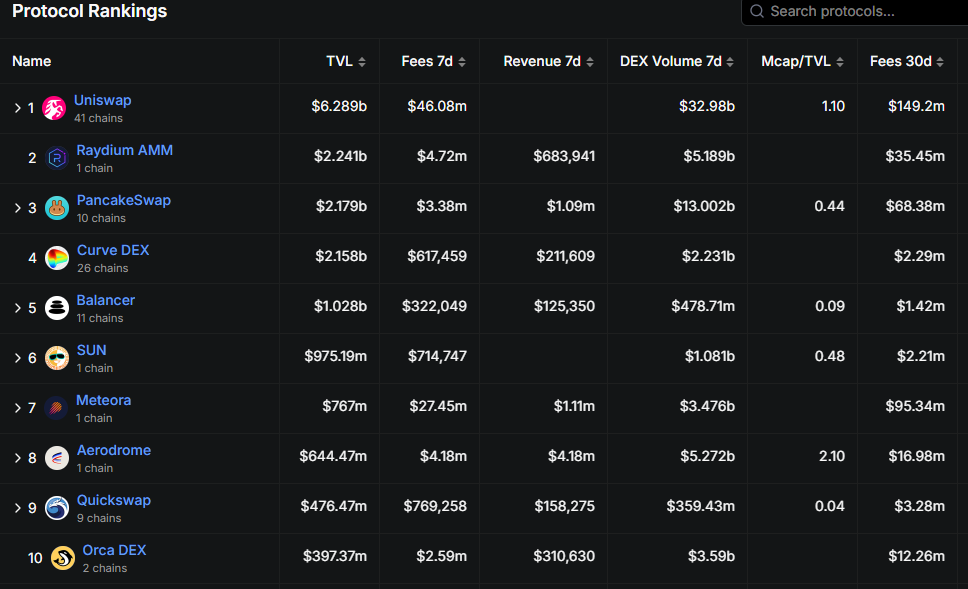

For beginners, DEX analytics tools can provide essential data about different platforms.

1. Uniswap

✅ Tradable assets: 10,000+ ERC-20 tokens

✅ Liquidity pools: 30,000+

✅ Trading fees: 0.05%–1%

✅ Best for: token swaps & liquidity provision

Uniswap was launched in 2018 on the Ethereum blockchain, and has remained the world’s leading DeFi platform for decentralized trading and other financial services. Uniswap was the first decentralized exchange that introduced the innovative AMM system to simplify trading. Currently, it is the world’s largest DEX with cumulative trade volume surpassing $2 trillion.

You can trade a wide range of ERC-20 tokens and participate as a liquidity provider, benefitting from its user-friendly interface. While Uniswap’s trading fees are relatively low, overall transaction costs can be high during Ethereum network congestion due to gas fees. Also, you should be aware of the possibility of impermanent losses if you want to start liquidity farming on this platform.

In 2020, Uniswap developers introduced the UNI token through a community airdrop as the native token of the Uniswap platform. This token plays a crucial role in community-driven governance of Uniswap. UNI holders can propose improvements, and the community votes on these proposals. Moreover, upgrades from V1 to V3 and the introduction of layer-2 solutions have brought improvements such as increased capital efficiency, concentrated liquidity, and customizable fee tiers.

2. Pancake Swap

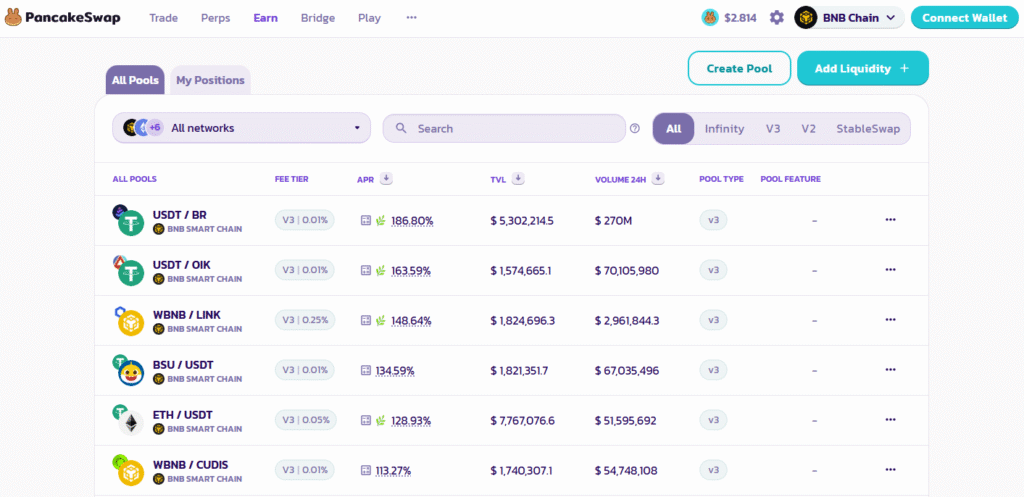

✅ Tradable assets: 3,500+ (multi-chain, mostly BNB Chain)

✅ Liquidity pools: 1,500+

✅ Trading fees: ~0.2%

✅ Best for: yield farming & staking

It is a popular decentralized exchange that was developed in 2020 by anonymous developers. Built on Binance Smart Chain (now BNB Chain), this platform offers low-cost trading through its AMM system.

Beyond trading, it also offers other financial services. You can stake crypto, participate in liquidity farming, trade perpetuals, and even buy and sell NFTs. This comprehensive service offering has positioned PancakeSwap as a leading DeFi platform and boosted its popularity in recent years.

CAKE is the native token of PancakeSwap, having versatile utility. You can use this token for staking, yield farming, and participating in governance. Moreover, lower fees, high liquidity, and a user-friendly interface are some of the features that make this platform unique.

3. dydx

✅ Tradable assets: 220+ perpetual markets

✅ Liquidity pools: Order book system (not AMM-based)

✅ Trading fees: 0.05%–0.1%

✅ Best for: perpetual futures trading with leverage

dYdX was founded by Antonio Juliano in 2017 and is built on the Ethereum blockchain. It offers spot trading along with advanced financial products such as margin trading and perpetual contracts. These features make the platform particularly attractive to professional traders, especially those who want to trade perpetuals.

What sets dYdX apart is its order book system. In earlier versions, orders were placed off-chain and matched by dYdX Trading Inc., then settled on-chain through the StarkEx Layer-2 scaling solution, which reduced gas fees and increased trade execution speed. With the launch of dYdX v4, the protocol now operates on its own Cosmos-based blockchain, where the order book and matching engine are run by a decentralized validator network. This design maintains fast trade execution and helps minimize price slippage.

The platform supports a wide range of perpetual markets, and users can also participate in governance through the dYdX token. Overall, dYdX is well-suited for professional traders, though its advanced features may present a learning challenge for beginners.

4. Curve Finance

✅ Tradable assets: Stablecoins & pegged assets (USDC, DAI, USDT, WBTC, etc.)

✅ Liquidity pools: 100+ optimized for stables

✅ Trading fees: 0.01%–0.04%

✅ Best for: stablecoin swaps with ultra-low slippage

It is another DeFi exchange built on Ethereum, that focuses on trading of stablecoins and assets that trade at similar prices like different wrapped BTC versions. It was founded in 2020 by Michael Egorov specifically to provide efficient trading services for DeFi users.

Curve Finance focuses on providing liquidity for stablecoins, so users can trade these coins efficiently with minimal price slippage. Curve’s unique AMM algorithm achieves that by keeping stablecoin trading close to 1-1, like $1 for $1 (even for large trades), by making the pricing formula less sensitive to trade size around that point. This enables stable prices and also incentivizes liquidity providers because the risk of impermanent loss is greatly reduced.

CRV, the native token of Curve, is used as a governance token for various platform upgrades. Users can also lock (vote-escrow) this token as veCRV to gain governance power, and earn rewards.

5. 1inch

✅ Tradable assets: Aggregates 389+ liquidity sources across 11 chains

✅ Liquidity pools: Aggregated (not native pools)

✅ Trading fees: Varies per connected DEX

✅ Best for: finding best swap rates & gas optimization

It is a decentralized exchange aggregator developed by Sergej Kunz and Anton Bukov in 2019. Initially built on the Ethereum blockchain, this platform has since expanded to multiple chains and was designed to make trading efficient by providing best rates and trade paths.

Rather than acting as an exchange itself, it executes trades on various DEXs at the best possible rate and returns the desired crypto to the trader. It is made possible with its Pathfinder algorithm which determines the best possible trade path considering factors like fees and liquidity. A wide range of tokens and coins are available and can be traded without experiencing much slippage. Unique thing about this platform is that it also allows limit orders to specify desired price for traders.

Through the aggregation feature, users can enjoy deep liquidity and best rates for trading.