Both 2022 and 2023 were not favourable for most of the cryptocurrencies. During this period, the prices of cryptocurrencies like ETH, BTC, and BNB reduced significantly. ETH which is the second largest crypto in terms of market capitalization had its ATH in 2021 at price of $4,800 driven by increased market confidence, increasing institutional adoption and rise of DeFi applications.

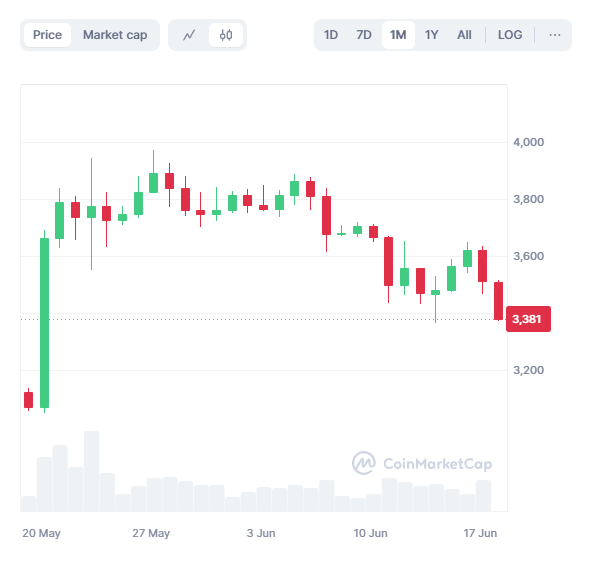

Major reasons for reduced price in 2022, included high interest rates, bankruptcy of FTX, and Celcius Network, Terra (LUNA) collapse, followed by increased regulatory oversight, reduced investor confidence and decreased DeFi activities in 2023. With the start of 2024, the price of ETH has increased significantly with major reason being the halving event which was scheduled for 2024. The growth of DeFi applications, increasing institutional adoption of ETH, and halving event played an important role in boosting the price of ETH. From 21st May to 11th June 2024, ETH price has remained between $3,600 and $3,800 with certain fluctuations and decreased to $3400 after that.

Currently, ETH/USDT pair is being traded at $3413. Ethereum 2.0 updates and continued growth of DeFi applications are also playing an important role in sustaining investor confidence. Also, recently, SEC has approved spot ETH ETFs although final approvals are pending. This could also be favourable to ETH price. Given that most of the market events are favourable for ETH price, its price may increase further in long term. Experts predict the market to be bullish in long-term.

From April to May 2024, ETH price decreased from $3500 to $3000 but it shown resilience and reached up to more than $3500 in June. In short-term, it experienced multiple bearish trends. The price struggled to surpass $3600 in last week but can certainly go beyond after this summer. Latest predictive research insights indicate Ethereum in 2024 may have a resistance level at $3823.15 and support at $2572.46. Some experts also have bullish sentiments on ETH price due to ETF approval, and continued market growth. Also, the Dencun upgrade which includes 9 Ethereum Improvement Proposals for Ethereum blockchain, which would reduce gas fees, improve scalability and security, can also boost the price. This update overall improves Ethereum network efficiency leading to more positive market sentiments and confidence in using DeFi applications. Currently, fear & greed index of overall crypto market is neutral according to Coinmarketcap. Crypto adoption may keep increasing due to rising popularity of decentralized applications.