Gold Sell Entry Price (2990)

Take Profit (TP): 2950

Stop Loss (SL) 3010

How to Gold Buy or Sell

Gold Market Overview

The price of gold (XAU/USD) has seen significant increases in recent years, which has become a focus of attention for investors and traders. In February 2025, the price of gold reached $2,954.95 per ounce, a new all-time high.

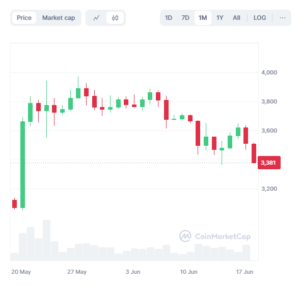

Recent Price Performance

In early March 2025, the price of gold exceeded $2,900, driven by global trade tensions and inflation concerns. In addition, China’s central bank has increased its gold reserves for the fourth consecutive month, indicating growing demand for gold.

Technical Analysis

Technically, the price of gold continues to trend upward. The price broke a symmetrical triangle pattern last month, which was followed by a sharp increase. The Relative Strength Index (RSI) indicates positive momentum, but also points to potential overbought conditions. According to the measurement technique, the next possible target is $3,098.

Fundamental Factors

The fundamental factors influencing gold prices include global economic uncertainty, trade tensions, and inflation concerns. In addition, increased gold purchases by central banks also support prices. For example, China’s central bank increased its gold reserves in February 2025.

Future Forecasts

Several financial institutions have released their projections for gold prices. Goldman Sachs predicts that the price of gold will reach $3,100 by the end of 2025, while Morgan Stanley expects the price to fall to $2,700 by the fourth quarter, provided that a peace agreement is reached between Russia and Ukraine.

Conclusion

Overall, gold prices are expected to continue to rise, but investors should be prepared for potential volatility. Global economic conditions, trade policies, and geopolitical factors can have significant impacts on gold prices.